Use Financial Modeling to Critically Assess Compensation in Differing Job Opportunities

By: Sanjeev Bhatia, M.D. and Kirk A. Campbell, M.D.

One of the most common reasons newly minted Orthopaedic Surgeons change jobs after the first few years is having dissatisfaction with actual compensation vs. perceived compensation. After years of hard work, possible relocation and delayed gratification, it is only natural that new surgeons and their spouses would seek something perfect and permanent in an employment situation. Unfortunately, many Orthopaedic Surgeons do not have the time, tools or experience when critically evaluating the compensation model within their first employment opportunities and are frequently disappointed by their circumstances when it is different from what they envisioned. Sadly but more common than not, this situation often leads to significant personal and familial stress, professional insecurity and financial hardship.

Here we will present a simple method Orthopaedic Surgeons can utilize in financially modeling their net worth across various job opportunities they may be exploring. At its core, the technique employs a simple sensitivity analysis, similar to what professional analysts on Wall Street use, to simulate various "what if" scenarios financially. The purpose of financial modeling is to simplify complex compensation arrangements typically seen in orthopaedic surgery employment, and identify large discrepancies in compensation and risk to the young surgeon early on in the job search process.

Don’t Just Think About the Money

Although we are focusing our discussion on financial compensation, it is critical to note that earning potential is not the only factor to consider when evaluating employment opportunities. Other factors including practice quality (i.e. reputation, growth potential, ancillaries and financial strength, etc.), academic opportunities, partners, location and spouse happiness should be heavily weighted. That being said, compensation is often cited as one of the top two causes Orthopaedic Surgeons change employers. It is very common for young surgeons to leave a certain practice because their compensation expectations are vastly different than what they were actually paid. This situation is often exacerbated by the incredibly complex compensation arrangements, overhead cost formulas and partnership costs seen in various orthopaedic practice environments in our health care system.

What is Financial Modeling?

Financial modeling, in the finance world, is the process of creating a summary of a company's expenses and earnings, in the form of a spreadsheet, that can be used to calculate the impact of a future event or decision. Company executives frequently use these tools to guide decisions and estimate stock prices. Despite its seemingly complex uses, the process is relatively straightforward and may be of value to young physicians—chief executives, of sort, for their own careers—in their job decision-making process.

Model Your Financial Situation Across Various Jobs

If you can estimate, roughly, what you may be expected to take home yearly in each job opportunity as well as various other costs (living expenses for your family, partnership buy-ins and taxes), a simple spreadsheet program may be a valuable tool in financially modeling your net worth in various job opportunities. In some situations, the practice may provide a range of what other partners in the same subspecialty are taking home as a guide for compensation; you can also utilize compensation data from the Medical Group Management Association (MGMA) as a reference. If you plan to invest your disposable income, it is helpful to estimate living expenses and expected rate of return in order to see what you may actually be able to save and compound over time.

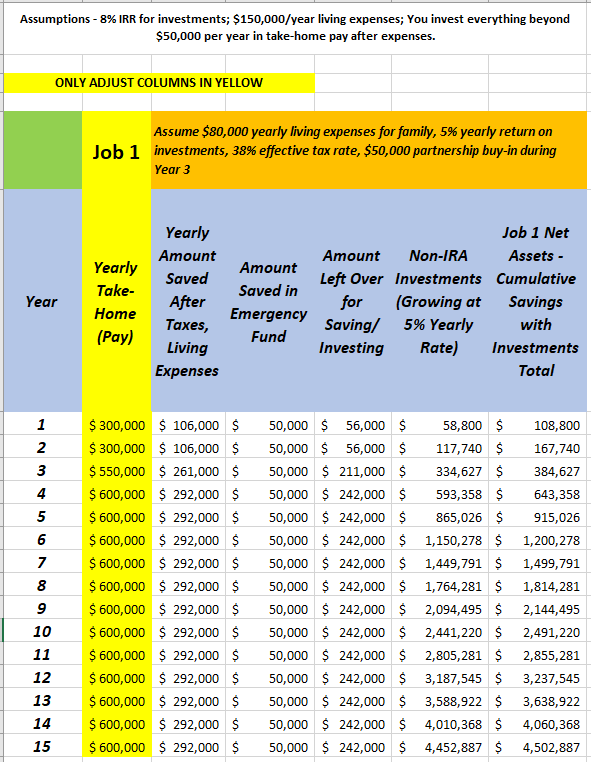

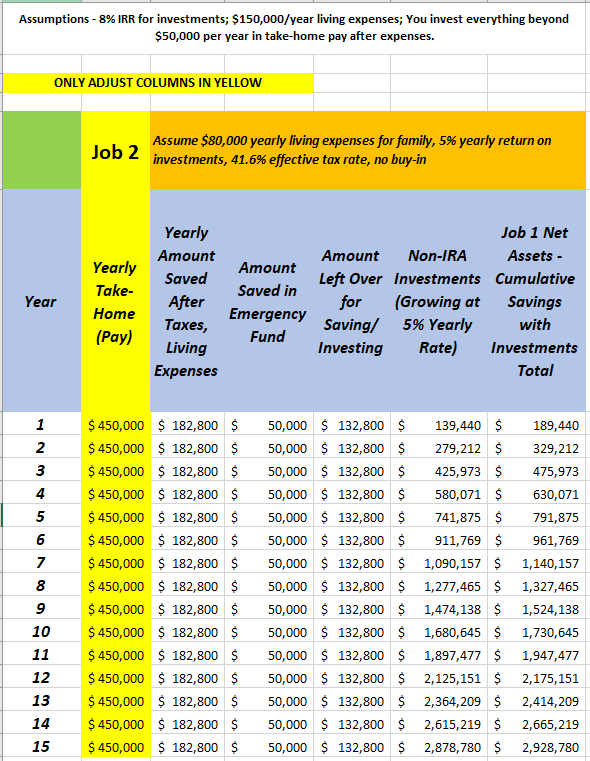

To illustrate, Figure 1 is an example spreadsheet that was designed on Microsoft Excel. The spreadsheet depicts a hypothetical private practice employment opportunity offering a $300,000 starting salary and a $50,000 partnership buy-in cost during Year 3. Like many private practice opportunities, income in partnership is dependent on production, but the practice provided an estimate. Figure 2 shows a spreadsheet reflecting a second job opportunity with a $450,000 annual salary in a state with higher taxes.

Figure 1. Hypothetical Job Offer (Job 1) proposing a $300,000 starting salary and a $50,000 partnership buy-in cost during Year 3, with production-based income thereafter.

Figure 2. Hypothetical Job Offer (Job 2) proposing a $450,000 annual salary in a state with higher taxes.

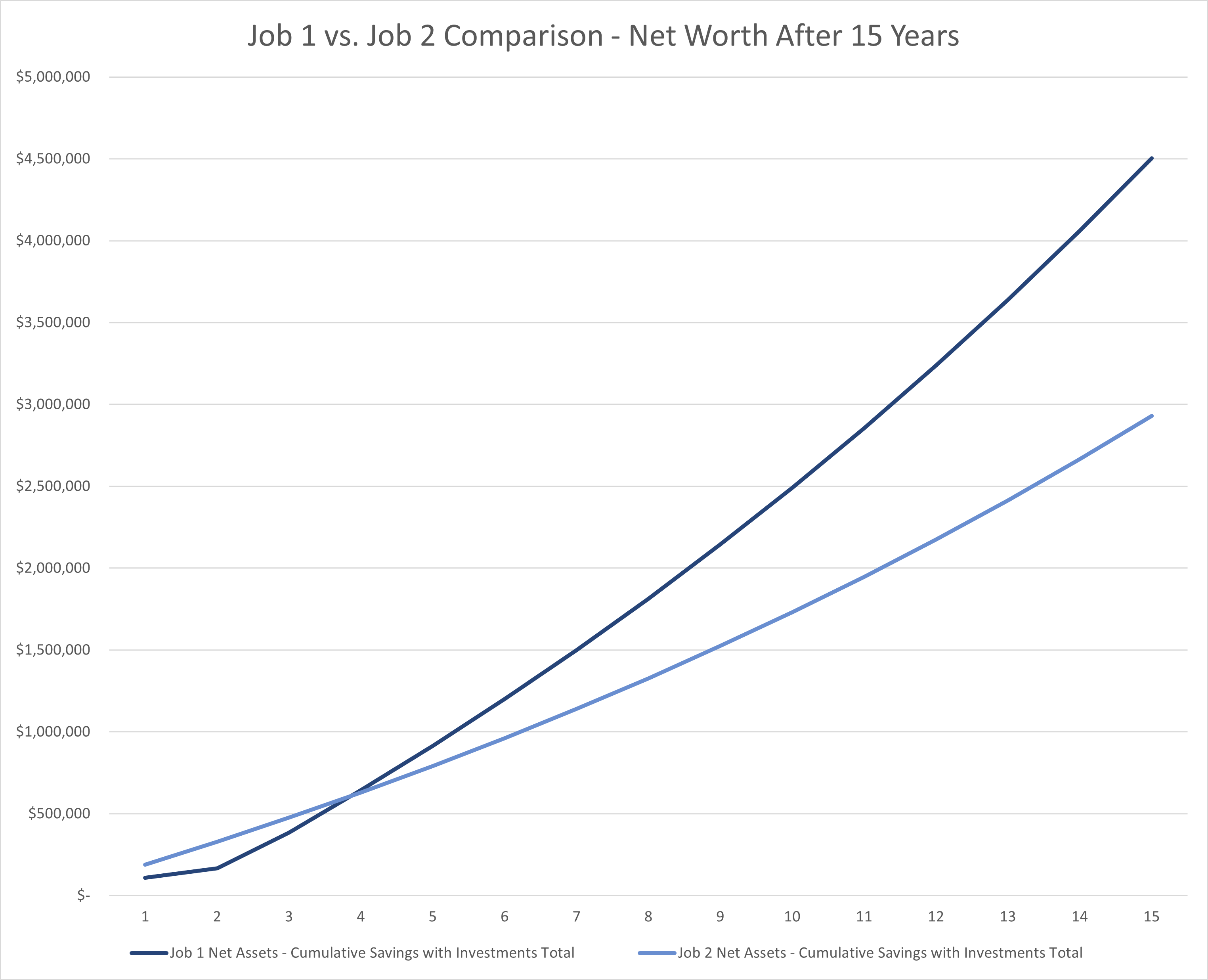

If you wish to take it a step further, you can graphically depict your net worth in various job opportunities side by side (Figure 3). Although it sounds like an overly analytical exercise, such efforts may help you visually compare the trajectory of your earning potential in various job settings. In the example provided, one can see that although Job 2 had a $150,000 higher starting salary, after four years the two job opportunities broke even financially with Job 1 having a far higher trajectory for earnings growth long term. The value of this exercise is that it allows young surgeons to easily model a "worst case" and "best case" scenario for each employment offer to better understand the financial risk and reward in relation to other factors weighing on their decision. The above example is a simplified way of evaluating two or more job prospects, but it should be noted that actual models can be more complex, and one should consult with a certified financial planner or other financial professional to discuss their particular situation.

Figure 3. Graphical side-by-side comparison of the net worth attained in both opportunities over a 15-year period given the listed income estimations. Note that the "break even" point occurs after Year 4, with Job 1 having a higher trajectory for growth thereafter.

Conclusions

Searching for a job is one of the most stressful but exciting times in one’s career. Although the financial aspects of a job should never be the most important factor in choosing a certain position, too often young surgeons poorly understand their compensation expectations, including those of taxes and partnership buy-in, which may lead to discontent later. Financial modeling is a simple tool that may help young surgeons simplify complex compensation arrangements inherent to orthopaedic surgery contracts, identify large discrepancies in compensation and gauge physician risk of various employment offers early on in the job search process. This is a powerful tool for the young surgeon to compare "apples to apples" and provides critical data to make a financially sound decision when selecting a job.